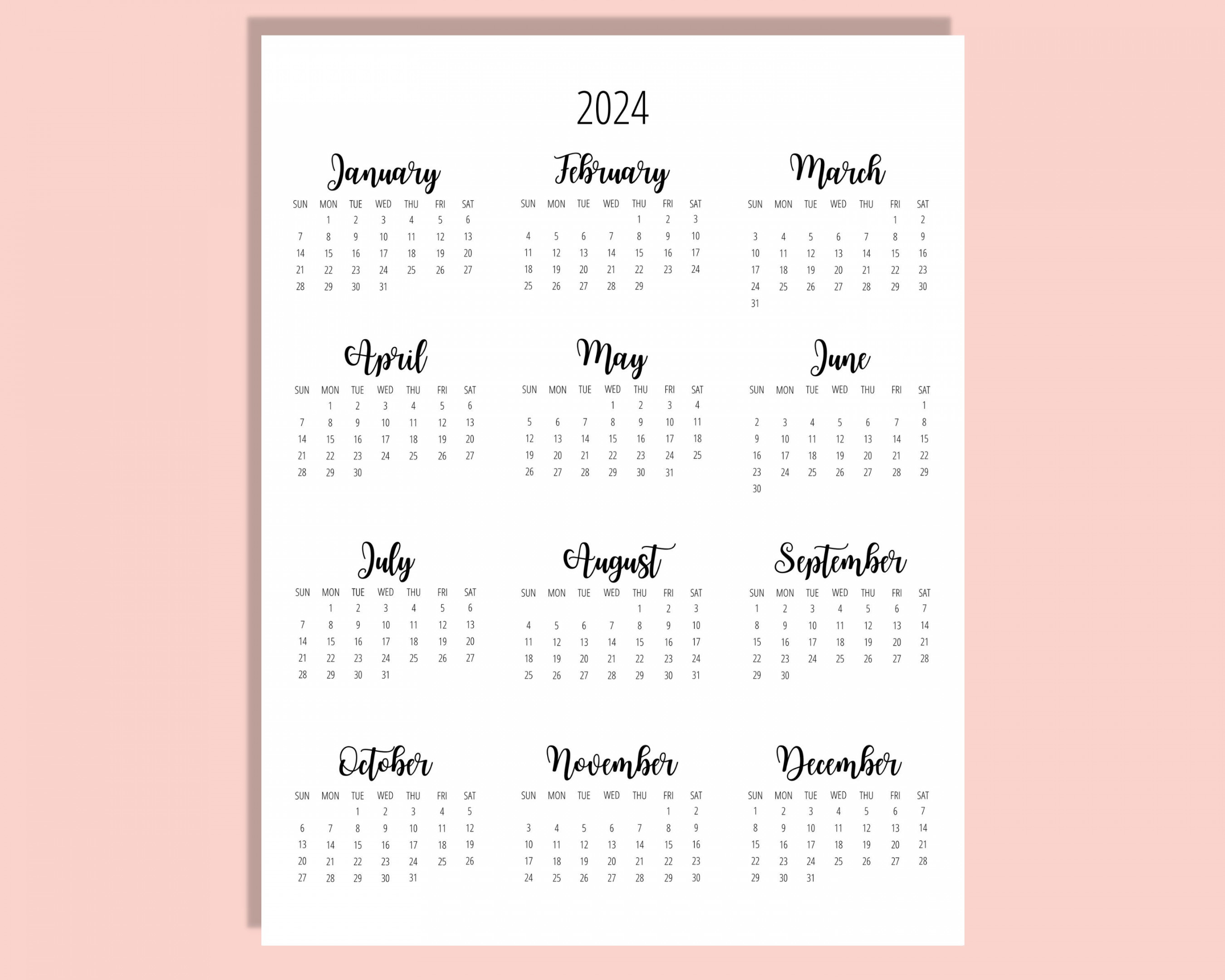

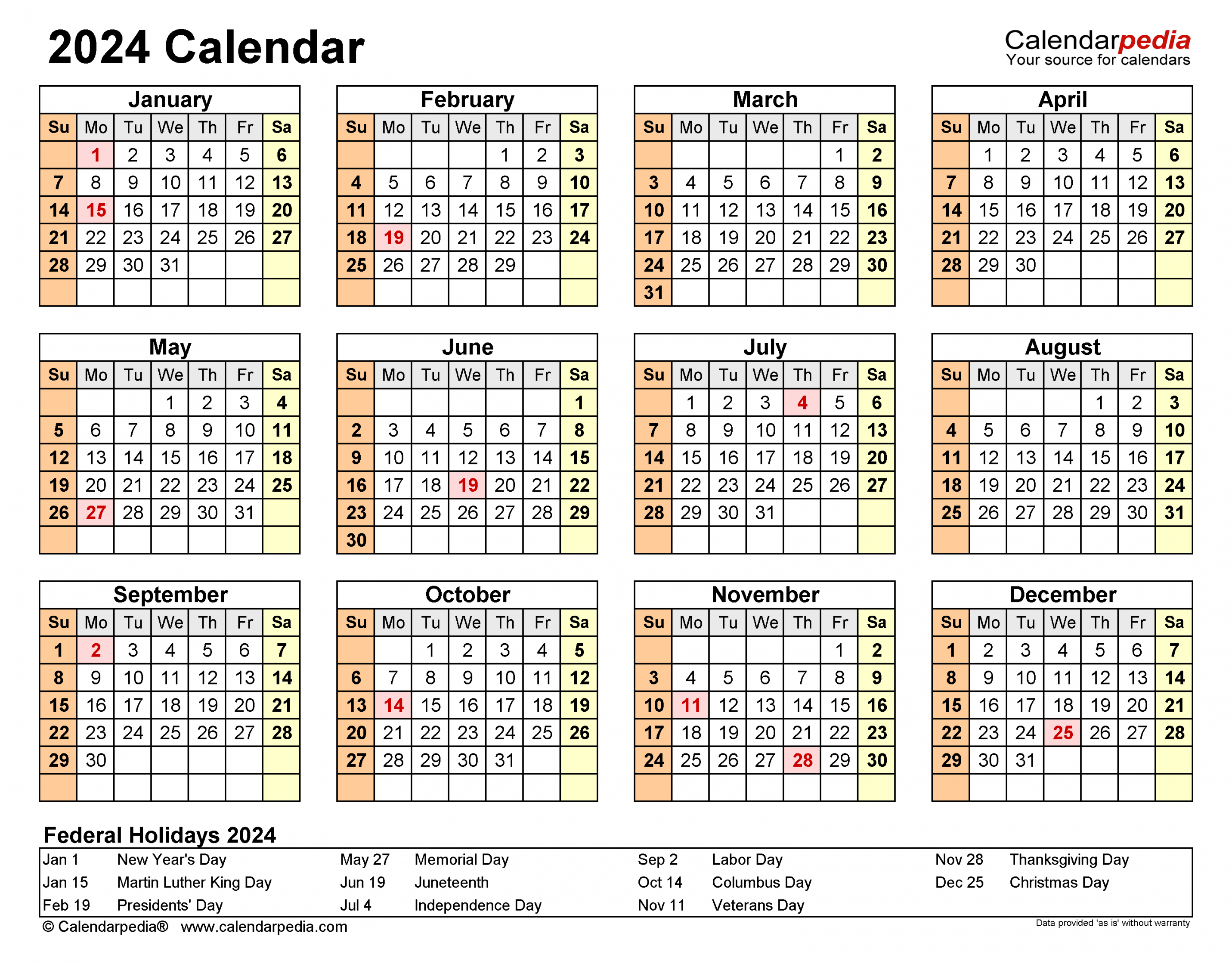

Calendar 2024 Malaysia Template

The Winners and Losers From Malaysia’s 2024 Spending Plan

(Bloomberg) — Malaysia unveiled a smaller 393.8 billion ringgit ($83.3 billion) spending plan on Friday as the country aims to reduce its budget deficit in 2024 and boost investor confidence with its fiscal discipline.

Prime Minister Anwar Ibrahim said his government will trim spending on subsidies by around 11.5 billion ringgit as it moves toward targeted assistance, while aiming to grow the economy by 4% to 5% next year.

Article content

READ: Absence of 1MDB Debt Payment Lets Malaysia Lower 2024 Budget Gap

Here’s a look at some of the key winners and losers.

WINNERS

Construction Sector

The government has planned several infrastructure jobs for next year including the revival of five previously canceled stations for its light-rail transit LRT3 project worth 4.7 billion ringgit. It also backed a new light-rail transit for Penang estimated at 10 billion ringgit and will widen the country’s main interstate highway. This should be a boost for construction and engineering firms such as Gamuda Bhd. and WCT Holdings Bhd.

Poultry Industry

Malaysia announced the lifting of price controls on chicken and eggs — in place since 2022 — which may benefit poultry firms such as Lay Hong Bhd. and Leong Hup International Bhd.

“There were reports of some companies not being able to sustain their operations” due to the price controls, said Amarjeet Singh, Asean Tax Leader at Ernst & Young.

New Energy Players

Malaysia will continue to expand its electric vehicle charging infrastructure and encourage EV adoption through rebates, which will help players such as Yinson Holdings Bhd. It will also increase the installation of solar panels, including at government premises, in partnership with Tenaga Nasional Bhd.

Article content

LOSERS

Logistics, Entertainment

Malaysia will raise its services tax to 8% from 6% and will widen the scope of taxable services to include entertainment activities and logistics. This could affect companies such as Genting Malaysia Bhd. and possibly Capital A Bhd.’s fledgling logistics arm. Essential services such as food and beverages as well as telecommunications are excluded from the levy increase.

Sugary Beverages

The government will also raise the excise duty on sugary drinks, which may affect beverage makers such as Nestle Malaysia Bhd.

“This was expected, it is a significant increase,” Amarjeet said. “The players will have to reconfigure the content of sugar.”

Tobacco

Malaysia will also increase its excise duty on tobacco products, as it continues to pursue anti-smoking legislation. This could potentially hurt tobacco firms such British American Tobacco Malaysia Bhd. even as the company tries to diversify its offerings from cigarettes.

Share this article in your social network