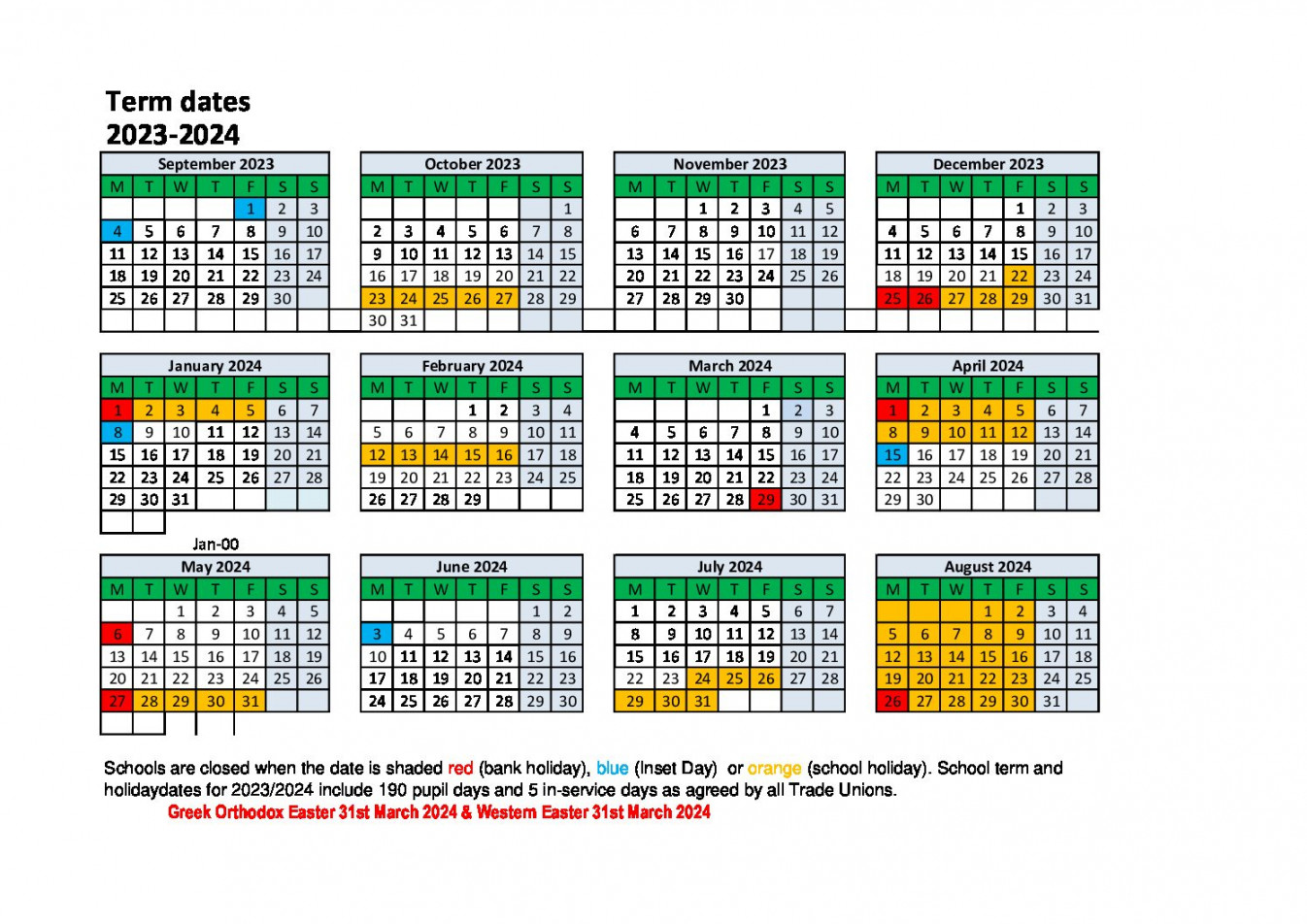

Term Dates For 2024

Medicare Guide 2024: What you need to know about your options

Open enrollment season for Medicare health and drug plans runs between Oct. 15 and Dec. 7. It’s when seniors 65 and older and younger Americans with long-term disabilities can switch providers of their comprehensive health and drug plans. Other Medicare enrollees can also make changes.

Here’s a guide to some of the choices enrollees face.

Oregon resources during open enrollment

BASIC MEDICARE

About 66 million Americans are eligible for basic Medicare insurance, known as Parts A and B, according to the U.S. Centers for Medicare & Medicaid Services. Most are 65 or older, but nearly one in seven are younger with permanent disabilities.

In Oregon, nearly 928,000 people are enrolled, up 1.5% from 2022.

Premium: The Centers for Medicare and Medicaid Services said on Oct. 12 the monthly premium will climb 6% for next year to $174.70. That’s up from $164.90 in 2023. Higher income taxpayers (singles making more than $103,000 or couples earning more than $206,000) pay surcharges that also will increase in 2024, ranging between $69.90 per person per month to as high as $419.30 per person per month, depending on income.

Deductibles: The Part A hospital deductible will increase to $1,632 per occurrence. (Medicare Advantage enrollees pay no deductible but often are charged daily copays instead). The Part B deductible will be $240, up from $226 in 2023, according to the trustees report.

Enrollment periods: There’s a seven-month enrollment window that begins three months before the month you turn 65. Those who miss this initial enrollment period can sign up between Jan. 1 and March 31 each year. Those who are 65 and older and still working have eight months after employment ends or group insurance coverage terminates to enroll.

Read more about Medicare Advantage from The Oregonian/OregonLive

MEDICARE ADVANTAGE

Fewer seniors stick with basic Medicare for their sole health insurance as more increasingly opt for private insurance to deliver or supplement their coverage.

More than 31.7 million, or 48% of eligible Medicare recipients nationwide, choose to have private insurers deliver their doctor and hospital coverage via Medicare Advantage plans, according to federal data. That share has more than doubled since 2007, according to the Kaiser Family Foundation. Most of these plans also offer prescription drug insurance, known as Part D.

In Oregon, nearly 500,000, or about 54%, enroll in Medicare Advantage.

Premiums: $0 to $200 per month in 2024 among plans in Oregon. That’s in addition to the monthly Medicare Part B premium mentioned above. Plans offered exclusively to Oregon PERS beneficiaries cost more. Most enrollees opt for a $0 copay plan, according to the nonprofit research organization Kaiser Family Foundation.

Enrollment period: Oct. 15 to Dec. 7

PRESCRIPTION DRUG PLANS

More than 22 million basic Medicare enrollees also buy a standalone prescription drug plan — coverage that basic Medicare doesn’t provide. They cover only medications, not care. Enrollment in these plans has been decreasing as more people opt for Medicare Advantage plans.

In Oregon, 260,000 people enroll in these so-called Part D plans.

Premiums: Premiums vary widely. In Oregon, Part D premiums range between $0 and $127 a month in 2024. High-income enrollees also pay a surcharge for Part D coverage that will range between $12.90 and $81 per month in 2024.

Enrollment period: Oct. 15 to Dec. 7

MEDIGAP

Roughly 14.5 million Americans opt for Medicare supplemental plans known as Medigap plans instead of Medicare Advantage plans, according to America’s Health Insurance Plans, a trade group. These policies cover Part A and B deductibles, copays and other cost-sharing requirements that basic Medicare doesn’t. In Oregon, 176,000 people buy Medigap coverage, down slightly from a year ago, according to the Oregon Department of Financial Regulation.

Premiums: $29 to $306 a month in Oregon, depending on applicant age and plan type, according to Medicare.gov’s online plan search tool.

Enrollment period: Only for six months beginning the month a senior turns 65 or otherwise becomes eligible. After that, seniors can still buy a policy, but in most states, an insurer can, with some exceptions, deny coverage or charge premiums based on an existing health condition.

Birthday rule: Oregon is one of only two states in which seniors can switch Medigap plans during a period that starts with their birthday and ends 30 days later (In California, the birthday window is 60 days). This rule allows them to move to the same type of plan offered by another insurer. They can also move to a different type of plan with fewer benefits, such as from a Plan G to a Plan B. Seniors in employer-sponsored group Medigap plans are not eligible.

Online resource: Medicare.gov’s Plan Finder now offers an expanded search engine where consumers can get a better sense of the cost ranges of each type of Medigap plan based on their age and gender. Check it out at bit.ly/MedigapPlanSearch. You’ll also find a link to it near the bottom of the Plan Finder’s homepage. However, you might get better cost estimates from private health-insurance brokers or free counselors with State Health Insurance Assistance Programs (SHIPs). Oregon’s SHIP is the Oregon Senior Health Insurance Benefits Assistance program, or SHIBA.