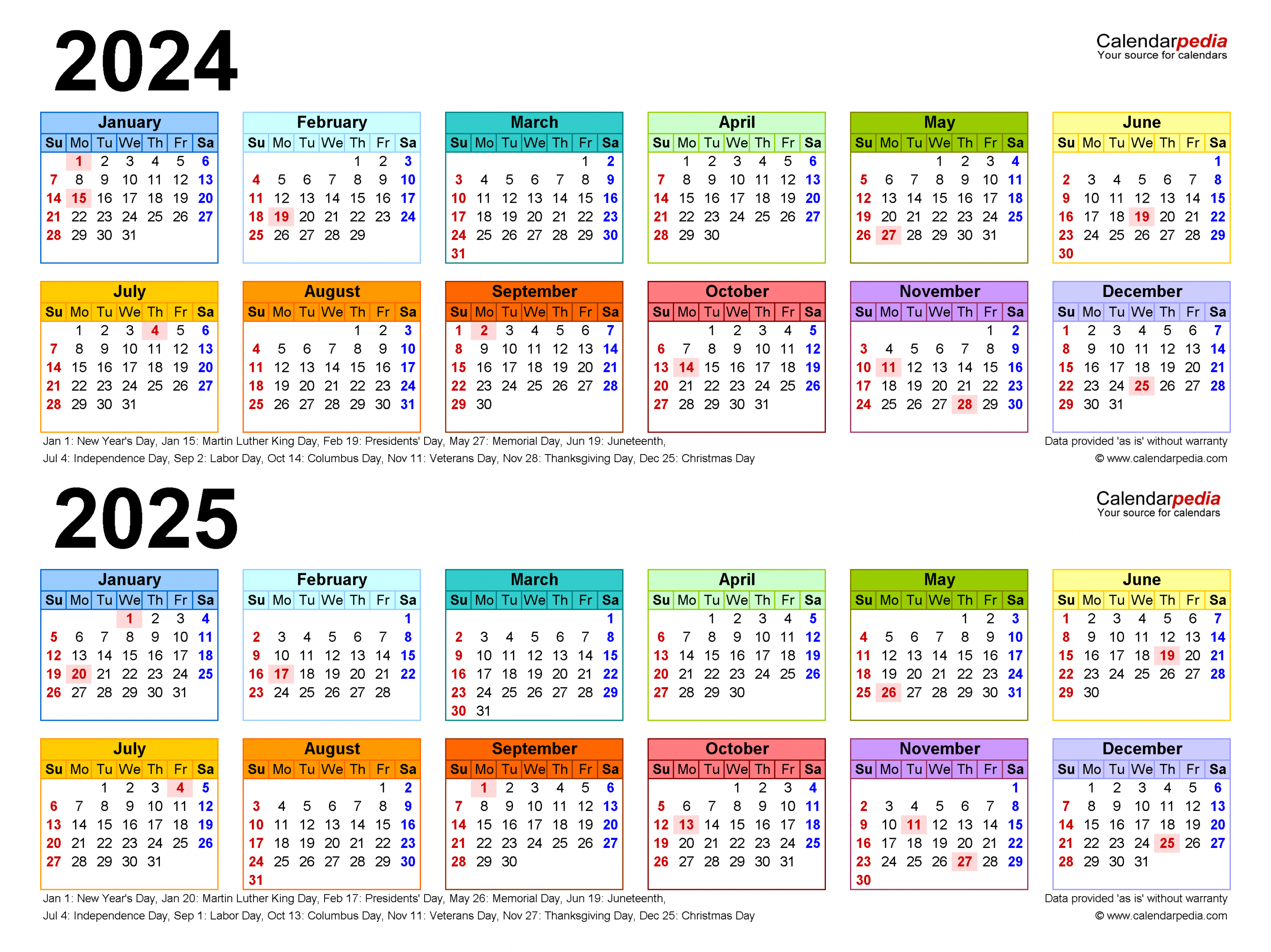

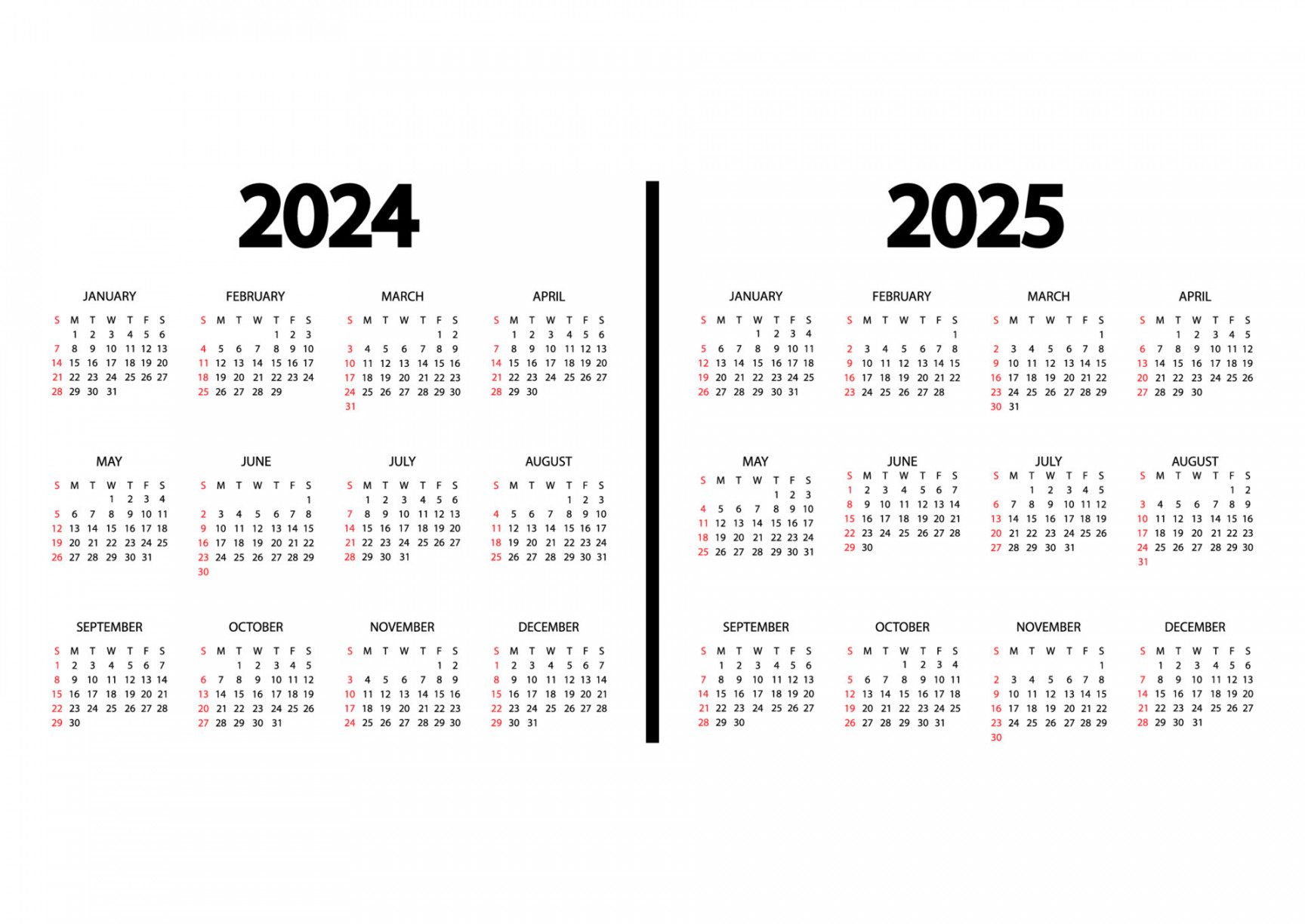

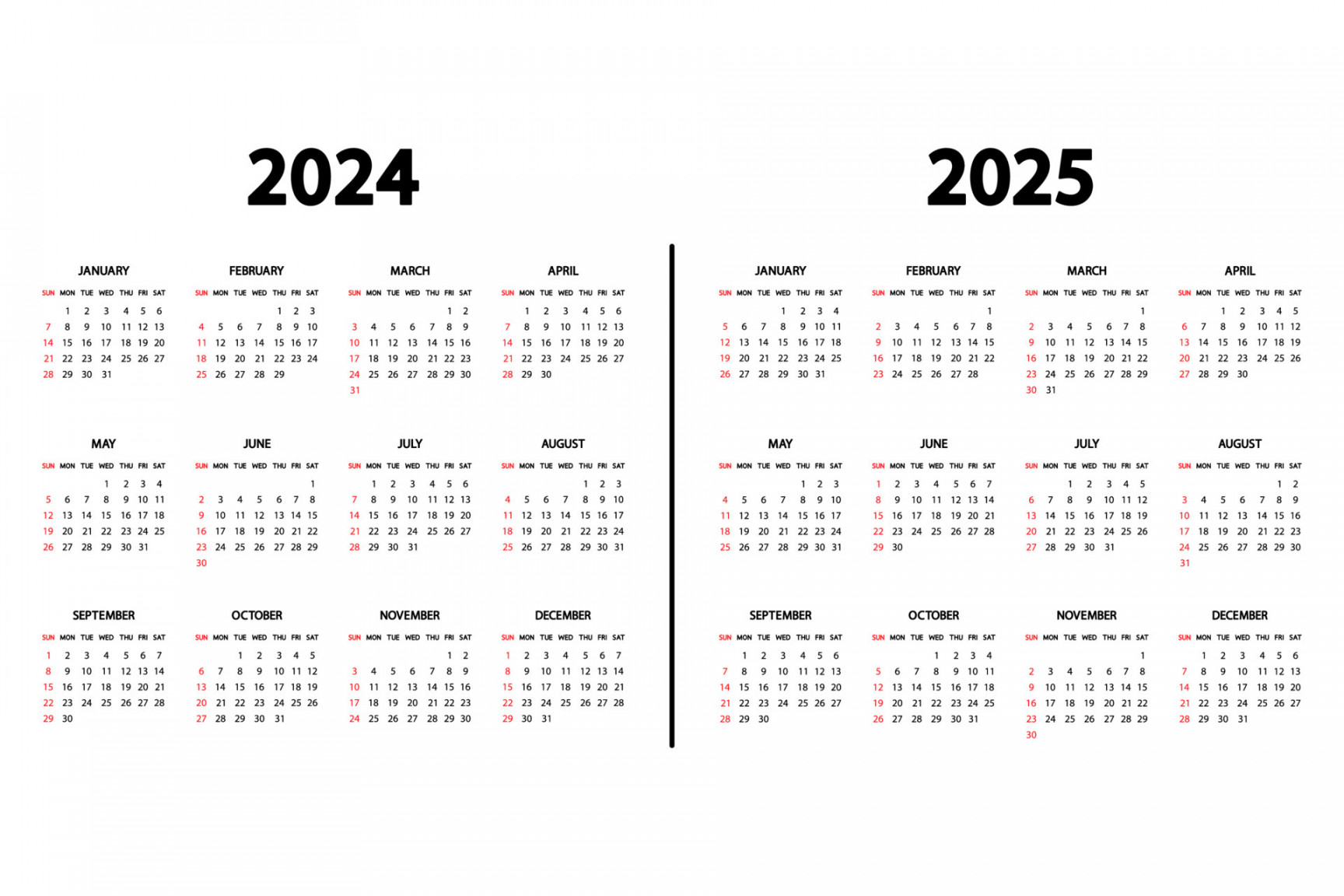

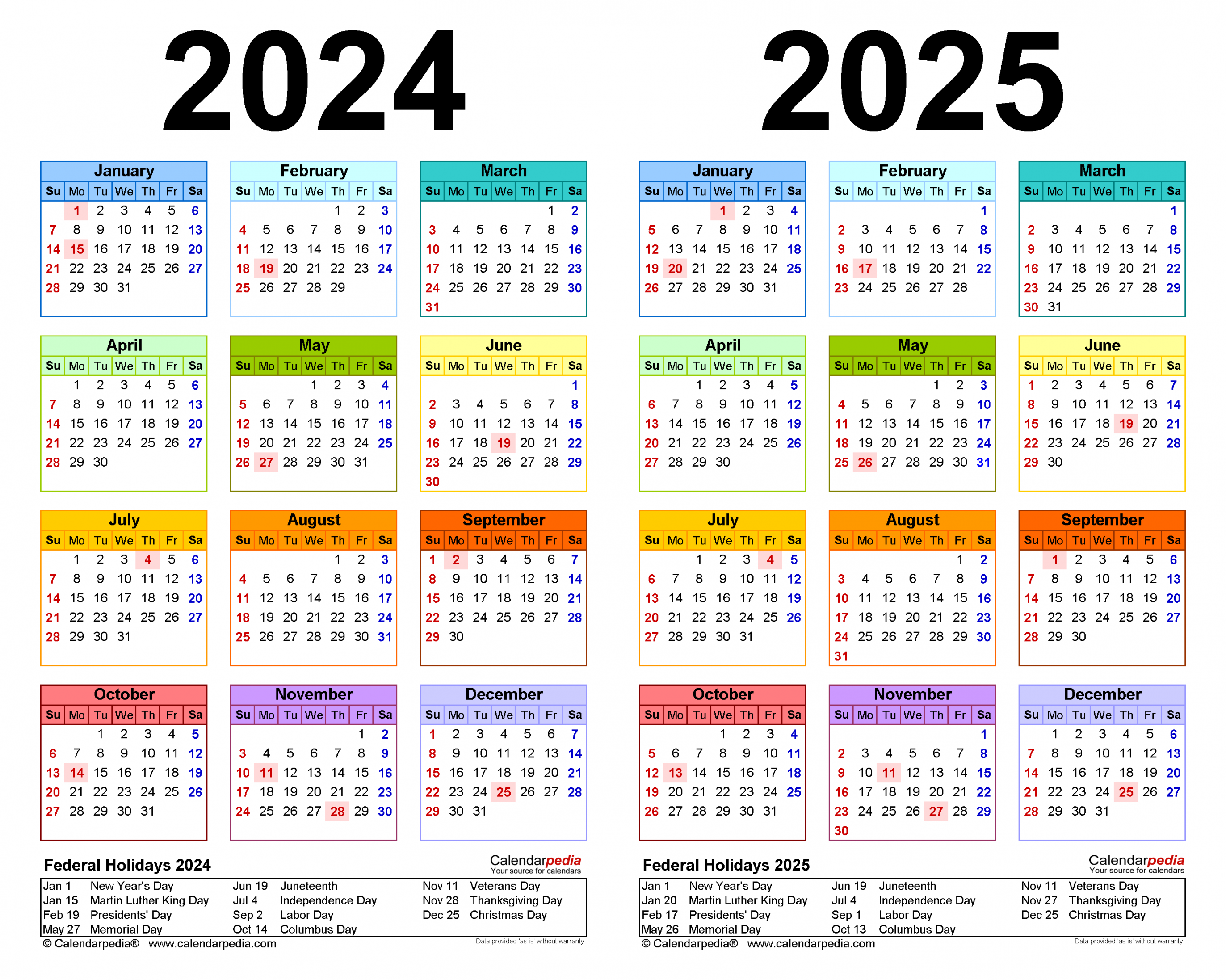

Calendar Year 2024 And 2025

9 Inflation-Related Tax Predictions for 2024 Retirement Planning For married individuals filing joint returns and surviving spouses, the maximum zero rate amount for 2024 is projected as $94,050, versus $583,750 for the maximum 15% rate amount.

For married individuals filing separate returns, the maximum zero rate amount projection is $47,025, compared with $291,850 for the maximum 15% rate amount.

For heads of households, these projected amounts are $63,000 and $551,350, respectively.

For all other individuals, these projected amounts are $47,025 and $518,900.

For estates and trusts, these projected amounts are $3,150 and $15,450.

As Bloomberg Tax notes, the 20% capital gains tax rate applies to adjusted net capital gain above the maximum 15% rate amounts.

Credit: Shutterstock